0.5% IRS (TAX INCOME) makes all the difference.

CCPC TAX NUMBER

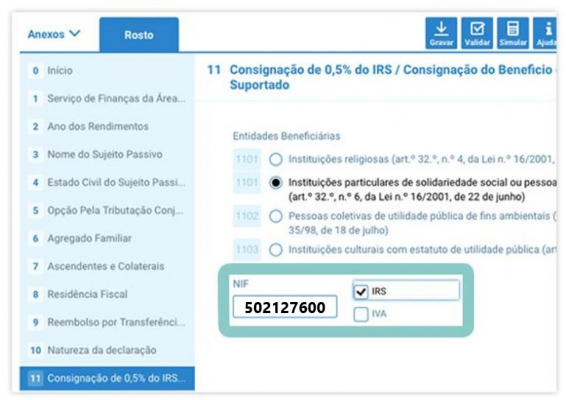

NIF: 502 127 600

It is very simple and free of charge. In a reimbursement scenario, you do not receive less and in an additional tax scenario, you do not pay more. This type of consignment consists of attributing to an entity 0.5% of the paid IRS (tax income that falls to the State after deducting deductions from collection). Thus, the tax that would remain for the State will be handed over to the cause that it chooses to support, in this case to the Community Center.

Between the 1st of April and the 30th of June, the period for submitting the Income Statement to the Finance Portal takes place. At the time of filing the IRS statement, follow these steps:

“FORM 3”

You can make your donation of 0.5% tax income through the traditional annual income statement (form 3), in Table 11 of the annex.

YOU CAN DO MORE

You can allocate the 15% of the value of VAT, thus giving up the amount that would be refunded to you.

If your IRS declaration is filled in automatically, just indicate that you intend to donate 15% of the input tax, waiving this amount that would be refunded to you.

We count on you!

Share it with your family and friends